How To Get Car Collateral Loans BC With Bad Credit Score

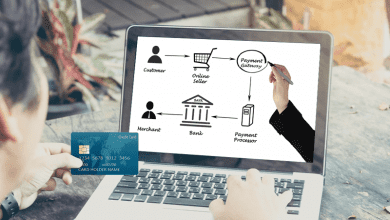

Some people with poor credit can find it difficult to borrow money. There is an option that you may want to explore if your application has been denied or you are struggling to find a private loan lender. The details of your financial situation can be taken into consideration to get loans without a bank account. You might have heard of lenders who provide loans with no bank account. Car Collateral loans BC is available for personal use or business purposes. As long as the loan can be paid back on time, getting loans with no bank account is sometimes easier as it requires less paperwork.

There are several types of collateral loans in BC that you may want to consider if you have some valuable assets but not many savings in a bank account. There is a type of business or personal loan that you can use if your application has been rejected or declined by other private lenders.

How To Get Collateral Loans With Bad Credit Score

Lenders will require a surety to the repayment of the debt. The debt may be paid by you or another person. You can use your assets such as a car, house, or business as collateral to borrow from a lender. There are several types of collateral loans you may consider getting and each one has something that is unique in it.

Each type of collateral loan has its advantages and disadvantages. These options may not fit everyone’s needs. But if you are looking for fast cash delivery options after your financial application was denied, then consider reviewing Car Collateral loans BC to see which loan term is best for your situation.

Other Options – Equity Loans

If you are looking for a loan in BC, then equity loans are options you may want to consider. It combines characteristics of many different types of collateral loans and it can be used as a personal loan or business loan. Personal equity lines of credit have several features that make it one of the most popular types of collateral loans these days.

The amount that is borrowed by this type of collateral loan may range between $1,000 to $40,000. The main feature is the use of the borrower’s assets such as a house, car, or business to give an added value to cover the committed debt and provide some protection to the lender if you fail to repay on time.

If you are used to paying your high-interest rates and looking for lower payments, then this collateral loan can allow you to maintain your current credit card balance and pay less in the long run. The repayment period can go up to ten years if the interest rate is not adjusted.

Can I Get A Loan With Bad Credit While On Ei Benefits In British Columbia?

Well, you can get a loan despite your condition. But, you will have to find the right lender. Some lenders in British Columbia can actually help you out and give you a loan without asking what your financial situation is or how much money you are getting monthly. You will just have to work hard in order to receive the money and pay it back on time.

Why Do People Take Loans With Bad Credit?

As it is mentioned above, there are some lenders who can help people with bad credit by offering them an easy way for receiving a loan. A lot of people use a loan with bad credit to have an economic recovery after they had a hard time financially. They use this method not only to get out of the situation that they are in, but also to prepare for their future financial condition. Bad credit loans make it easier for them because they can borrow the amount that is required and make their lives better instantly.

So far, the main benefits of taking out a loan is as follows:

- If you need money urgently and you do not have access to your savings, then this method would be best for you.

- It is really hard to manage your expenses when you do not have any source of income. But, luckily there are people who can help you out by providing money through Car Collateral loans BC.

- If you are having a hard time paying your monthly bills and need extra cash to get by, then this loan is definitely right for you.

- Bad credit loans make your life easier as it becomes easier for you to have access to some money that can be used whenever and wherever it is needed.

- There are some people who only take out bad credit loans because they are in a difficult situation financially and they do not know how to get out of it.

- If this is the case, then you should consider this option. You will be able to improve your financial condition by taking out this type of loan in BC.